Loading

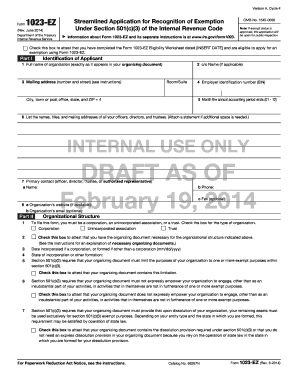

Get Form 1023-ez Rev June 2014 Internal Revenue Code 501c3 Streamline Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1023-EZ Rev June 2014 Internal Revenue Code 501c3 Streamline Application Form online

Filling out the Form 1023-EZ is an essential process for organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This guide provides clear, step-by-step instructions to help users with limited legal experience navigate the form effectively.

Follow the steps to complete the Form 1023-EZ online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- In Part I, provide the identification details of your organization. Fill in your full name exactly as it appears in your organizing document, mailing address, and employer identification number (EIN). Ensure the month your annual accounting period ends is correctly indicated.

- Complete the information for your officers, directors, and trustees. You can attach an additional statement if necessary.

- In Part II, indicate your organizational structure by selecting the appropriate checkbox for your entity type—corporation, unincorporated association, or trust. Ensure you have the relevant organizing document prepared.

- Attest that your organizing document contains the necessary provisions to ensure compliance with section 501(c)(3) requirements regarding purposes, limitations on activities, and dissolution.

- In Part III, enter the 3-digit NTEE Code that best describes your activities. Check all applicable boxes to confirm you are organized and operated exclusively for the indicated purposes.

- Review the prohibitions outlined in Part III and attest that your organization does not conduct any activities that violate these limitations.

- In Part IV, determine your foundation classification by selecting the appropriate box regarding public charity status, and provide necessary attestations.

- Finalize the application by signing the declaration in Part VI, ensuring the signer is authorized and provides their title and date.

- Once all sections are completed, save your changes, download or print the form, and share it as needed.

Complete your Form 1023-EZ online today to initiate your organization’s journey toward tax-exempt status.

More In Forms and Instructions Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Note. You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.