Loading

Get Form Ss-8 (rev. November 2006)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form SS-8 (Rev. November 2006) online

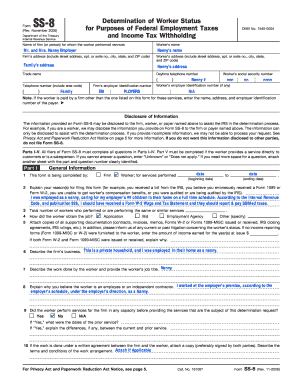

Completing Form SS-8 is essential for determining the status of a worker for federal employment taxes and income tax withholding. This guide will provide a clear and step-by-step approach to filling out the form online.

Follow the steps to fill out the Form SS-8 effectively.

- Click the ‘Get Form’ button to download the form and open it in your preferred format.

- Begin by entering the name of the firm or individual for whom the worker performed services, along with the worker’s name. Ensure you include clear details to identify both parties.

- Fill in the firm’s and worker’s addresses, including street address, apartment or suite number, city, state, and ZIP code. Accuracy here is essential for correct mail correspondence.

- Provide the firm’s employer identification number if applicable, as well as the worker’s social security number. This information is crucial for proper identification.

- Complete Part I, which covers general information about the work relationship, including dates of service, reasons for filing the form, and any supporting documents to attach.

- Continue to Part II, focusing on behavioral control. Describe the training provided to the worker and how work assignments are given. Document how complaints are handled and any required reports.

- In Part III, outline the financial control aspects such as equipment supplied by the firm and the type of compensation the worker receives. Clarity in this area will assist in determining worker status.

- Proceed to Part IV to discuss the relationship between the worker and the firm. This includes detailing benefits available to the worker and any termination conditions.

- If the worker provides services to customers, complete Part V, detailing the responsibilities the worker holds in soliciting new customers and any sales material involved.

- Review all the entries for accuracy and completeness. If additional space is needed for any answer, attach a separate sheet clearly identifying the part and question number.

- Sign the form, ensuring it is dated correctly. Stamped signatures are not accepted.

- Submit the completed form to the appropriate IRS address based on the firm’s location. Confirm that it is sent to the correct destination to avoid delays.

- Finally, save the form changes, and consider downloading or printing a copy for your records.

Complete the Form SS-8 online with confidence to ensure accurate determination of worker status.

The address where you mail IRS forms, including Form SS-8 (Rev. November 2006), varies based on your location and the specific form being submitted. Generally, the form's instructions will have the correct address listed, so it is critical to review those details carefully. For additional help, you can explore options on USLegalForms for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.