Loading

Get W-9 Form - Indiana Farmers Mutual

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

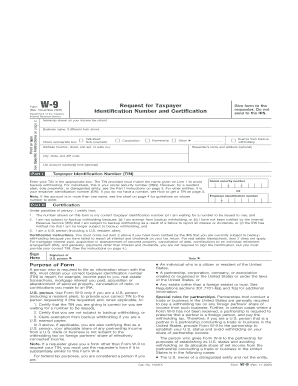

How to fill out the W-9 Form - Indiana Farmers Mutual online

This guide provides clear and comprehensive instructions on how to accurately fill out the W-9 Form - Indiana Farmers Mutual online. Whether you are an individual or a business, understanding each component of the form is essential for proper tax reporting.

Follow the steps to complete your W-9 Form online.

- Press the ‘Get Form’ button to retrieve the W-9 Form and open it in your preferred editor.

- Enter your name as it appears on your income tax return on the first line of the form.

- If your business name differs from your personal name, include it on the second line under 'Business name'.

- Select the appropriate checkbox to indicate your classification (individual/sole proprietor, corporation, partnership, or other).

- Enter your complete address, including the number, street, apartment or suite number, city, state, and ZIP code.

- In Part I, provide your Taxpayer Identification Number (TIN) in the specified box; for individuals, this is typically your Social Security Number (SSN).

- Review the certification statements in Part II and check the box indicating you are not subject to backup withholding, if applicable.

- Sign and date the form where indicated to certify the information provided is accurate.

- Once the form is completed, you can either save your changes, download, print, or share the W-9 Form as required.

Complete your W-9 Form - Indiana Farmers Mutual online today to ensure accurate tax reporting.

To obtain a copy of your W-9 online, visit platforms like uslegalforms that allow you to generate or request a copy. By entering your information, you can quickly get your W-9 Form - Indiana Farmers Mutual. This method saves time and ensures you have your documents ready when needed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.