Loading

Get 1008 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1008 Form online

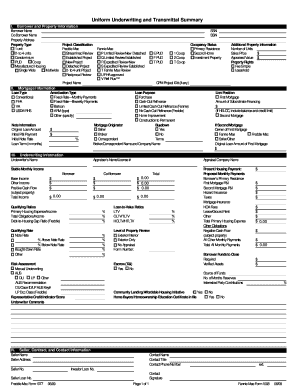

The 1008 Form, also known as the Uniform Underwriting and Transmittal Summary, is a crucial document in the mortgage application process. This guide provides clear and detailed instructions to help users fill out this form online effectively.

Follow the steps to complete the 1008 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the borrower and property information section. Enter the borrower name, co-borrower name, property address, and property type. Select the appropriate project classification from the list of options.

- Next, provide the Social Security Number (SSN) of both the borrower and co-borrower along with their occupancy status: primary residence, second home, or investment property.

- Move on to the mortgage information section. Here, you will indicate the loan type, amortization type, and loan purpose, selecting from options such as conventional, FHA, or VA.

- Complete the note information by entering the mortgage originator, original loan amount, and any buydown options as applicable.

- In the underwriting information section, provide details about the underwriter and appraiser, base income, other income, and total income. Complete any qualifying ratios and risk assessment details.

- Continue to describe the loan-to-value ratios, present housing payments, and total all monthly payments. Ensure accurate documentation of your funds to close and source of funds.

- In the seller, contract, and contact information section, enter the seller name and address, lien position, and any relevant financing details.

- Review all sections for accuracy and completeness to ensure that all required fields are filled.

- Once completed, save changes, download, print, or share the form as needed.

Get started on filling out your documents online today!

FHA loan underwriting took an average of 54 days: 54 days for a new home purchase and 55 days for a refinance in 2021. New purchases ranged from 50 to 61 days in 2021, with refinances ranging from 60 to 65 days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.