Loading

Get Ph Bir 1904 2000-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1904 online

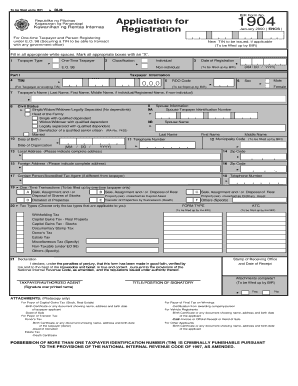

Filling out the PH BIR 1904 form is an essential step for individuals registering as one-time taxpayers in the Philippines. This guide will walk you through each section of the form, ensuring you understand how to complete it accurately and efficiently.

Follow the steps to fill out the PH BIR 1904 form with ease.

- Click ‘Get Form’ button to access the BIR 1904 form and open it in the designated editor.

- Identify the taxpayer type. In section 1, check the box for 'One-Time Taxpayer' to declare your status accurately.

- Complete section 2 by selecting your classification, indicating whether you are an individual or a non-individual.

- In section 3, write the date of registration in MM/DD/YYYY format. This section will be filled out by the BIR.

- Provide your Taxpayer Identification Number (TIN) in section 5 if you have an existing TIN.

- Fill in the RDO code in section 6, as requested.

- In section 7, write your name (Last Name, First Name, Middle Name) for individuals or the registered name for non-individuals.

- Complete section 8 by marking your civil status and ensuring all applicable boxes are checked.

- Next, fill in your date of birth in section 10, ensuring the format is MM/DD/YYYY.

- If applicable, provide your spouse's information in section 9, including their TIN, name, and other required details.

- Enter your local and foreign addresses in sections 13 and 15, making sure to include the complete address.

- In sections 18 and 17, provide contact information, including a telephone number for yourself or an accredited tax agent.

- If you are declaring one-time transactions, complete section 20 by marking the appropriate boxes relating to your transactions.

- Select the applicable tax types in section 21, ensuring only the relevant ones are checked.

- Finally, in the declaration section, sign and print your name. Ensure the declaration is made in good faith and all details provided are accurate.

- Once all sections are completed, you have the option to save changes, download, print, or share the form as needed.

Start filling out your PH BIR 1904 form online now for a smooth registration process.

Related links form

Yes, you can easily download BIR forms from the BIR's official website. This service ensures that you have direct access to all the necessary forms needed for your tax filings, including those related to PH BIR 1904. Simply choose the form you need, and download it for your use. This capability improves your ability to stay organized and compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.