Loading

Get Trust Information Summary Sheet - Bspm1comb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TRUST INFORMATION SUMMARY SHEET - Bspm1comb online

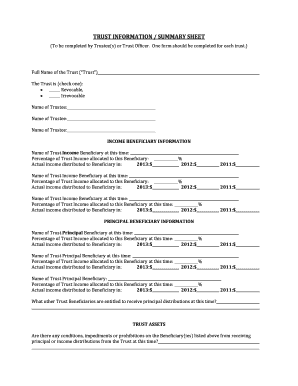

Completing the Trust Information Summary Sheet - Bspm1comb is an essential part of managing a trust, ensuring that all important details are accurately documented. This guide provides you with clear, step-by-step instructions to fill out the form online efficiently.

Follow the steps to successfully complete the Trust Information Summary Sheet.

- Click 'Get Form' button to access the form and open it for editing.

- In the first section, input the full name of the trust. Indicate if the trust is revocable or irrevocable by checking the appropriate box.

- Provide the names of all trustees in the designated fields. Ensure that all trustees are accurately listed.

- Fill out the income beneficiary information. Start with the name of the current income beneficiary and indicate the percentage of trust income allocated to them. Input the actual income distributions for the years 2011, 2012, and 2013.

- Repeat step 4 for any additional income beneficiaries listed on the form.

- Proceed to the principal beneficiary section. Similar to the income beneficiaries, input the name and income allocation percentage. Also, record the actual income distributions for the specified years.

- List any additional principal beneficiaries in the indicated fields, following the same procedure as before.

- Answer whether there are any conditions impacting the distribution of income or principal to the beneficiaries.

- In the trust assets section, record the current market value of all trust assets and the estimated annual trust income.

- Detail the portfolio mix by asset class, indicating the percentage for each category such as cash, stocks, bonds, real estate, partnerships, and others.

- If applicable, report any significant concentrations of any asset within an asset class.

- Indicate if any assets are categorized as restricted assets. If yes, provide details for these assets, including their income and value.

- Certify the accuracy of the information by signing and dating the form in the designated areas provided.

- Once completed, you can save your changes, download the form, print it, or share it as needed.

Complete your Trust Information Summary Sheet online today for seamless document management.

Lesson Summary A deed of trust is an agreement made between a lender and a property buyer (borrower) indicating that the lender will keep the legal title as long as the buyer pays the loan. The borrower gives the lender a promissory note as a promise to pay the debt, while the lender gives the borrower a deed of trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.