Loading

Get Westford Ma Tax Collector

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Westford Ma Tax Collector online

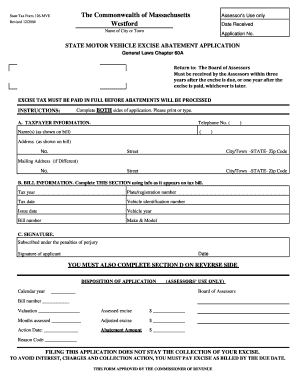

This guide provides clear instructions on how to complete the Westford Ma Tax Collector form for motor vehicle excise abatement applications. Whether you're a first-time user or someone looking for a helpful refresher, you'll find step-by-step guidance tailored to your needs.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to access the online application and open it in your preferred platform.

- In the 'Bill Information' section, fill out all the fields using the details on your tax bill. Ensure you include the tax year, plate/registration number, tax date, and vehicle identification number.

- Proceed to the reverse side of the application to complete Section D, indicating the reason for the abatement request. Check the applicable reasons and provide all requested documentation.

- Finally, download, print, or share the form as needed for submission to the Board of Assessors before the application deadline.

Complete your motor vehicle excise abatement application online today to ensure timely processing.

In Massachusetts, property tax is typically due on February 1 and May 1 each year. Homeowners should ensure they make timely payments to avoid penalties. The Westford MA Tax Collector office can provide you with specific details or reminders about these dates. This helps residents stay informed and manage their finances effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.