Loading

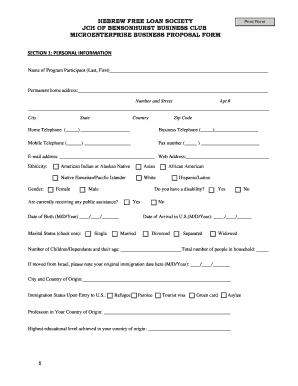

Get Hebrew Free Loan Society Jch Of Bensonhurst Business Club Microenterprise Business Proposal Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HEBREW FREE LOAN SOCIETY JCH OF BENSONHURST BUSINESS CLUB MICROENTERPRISE BUSINESS PROPOSAL FORM online

Filling out the HEBREW FREE LOAN SOCIETY JCH OF BENSONHURST BUSINESS CLUB MICROENTERPRISE BUSINESS PROPOSAL FORM is an important step for users seeking financial assistance for their business ventures. This guide provides a clear, structured approach to completing the form online, ensuring you have all necessary information at your fingertips.

Follow the steps to successfully complete the business proposal form.

- Press the ‘Get Form’ button to access the business proposal form and open it in your preferred online editor.

- Begin by filling out SECTION 1: PERSONAL INFORMATION. Provide your name, permanent home address, and contact details. Specify your ethnicity, gender, and date of birth. Indicate your marital status and the number of dependents. Also, include your immigration status and any relevant personal circumstances.

- Continue to SECTION 2: BUSINESS INFORMATION. Indicate whether you are starting, expanding, or purchasing a business. Fill in your business name, address, and provide a comprehensive description of your business idea, customer base, and market competition.

- Answer the questions regarding business ownership, operations, and financial information. Include your capital investment, expected sales, and reasons for requesting a loan. Clearly outline any potential risks to your business.

- In SECTION 3: APPLICANT DECLARATION, certify that the information you provided is accurate. Sign the declaration, and note the date.

- Review all sections carefully to ensure accuracy and completeness. Once satisfied with your entries, you may choose to save, download, print, or share your form.

Take the next step towards securing your business funding and complete the form online.

You can get a loan even if you're unemployed. Lenders look at multiple sources of income, including government benefits, alimony, and worker's compensation payments. If you have no income at all, you may be eligible for a secured loan using some form of property as collateral.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.