Loading

Get Sba 770 1987

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 770 online

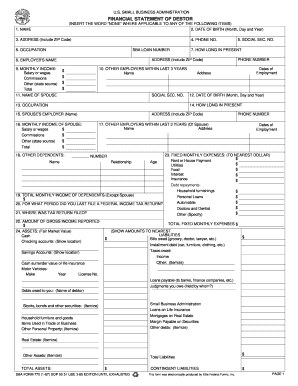

The SBA 770 is an important financial statement of debtor used in various loan applications managed by the Small Business Administration. This guide provides a detailed walkthrough on how to fill out the SBA 770 online, ensuring you provide complete and accurate information.

Follow the steps to successfully complete the SBA 770 form online.

- Click ‘Get Form’ button to obtain the SBA 770 and access it in the editor.

- Begin with Section 1 by entering your name as it appears on official documents. Ensure accuracy to avoid processing delays.

- In Section 2, provide your date of birth in the format of month, day, and year.

- Complete Section 3 by entering your address, including zip code, so that the SBA can reach you if necessary.

- For Section 4, input your primary phone number to allow for direct communication.

- Next, in Section 5, enter your social security number. Keep in mind that this is used for identification purposes by the SBA.

- Proceed to Section 6 and fill in your occupation to provide context about your employment status.

- In Section 7, indicate how long you have been in your current position by providing the duration.

- Section 8 requests your employer's name. This helps in detailing your current employment.

- Enter your monthly income in Section 9. Break it down into salary, commissions, and any other sources for clarity.

- If applicable, move to Section 10 and list any other employers you have had in the past three years, alongside relevant details for each.

- Fill out Section 11 if you are married; include your spouse’s name as needed.

- Continue by providing your spouse's social security number and date of birth in Sections 12 and 13 respectively.

- Provide your spouse's occupation in Section 14 and their employer's name in Section 15.

- Section 16 requires you to input your spouse's monthly income. Make sure all sources are stated clearly.

- In Section 23, detail your fixed monthly expenses such as rent, utilities, and insurance to provide a full picture of your financial obligations.

- Continue to Sections 24-34, completing fields related to your assets, liabilities, and any legal obligations to ensure full transparency.

- Review each section carefully for accuracy and completeness.

- Once all fields are completed, save your changes. You will have the option to download, print, or share the completed form as needed.

Start filling out your SBA 770 online today to ensure your application process is smooth and efficient.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The SBA 770 5-year rule typically refers to a requirement that borrowers must meet certain conditions within five years of receiving funding. This may include maintaining employment levels or achieving specific business metrics. Staying informed of this rule can help ensure compliance and avoid penalties down the line.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.