Loading

Get Iras

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iras online

Completing the Iras online can be a straightforward process when you have the right guidance. This guide provides step-by-step instructions to help you fill out the Iras form accurately and efficiently, ensuring that you meet all necessary requirements.

Follow the steps to complete the Iras form online.

- Click ‘Get Form’ button to obtain the Iras form and open it in your editing tool.

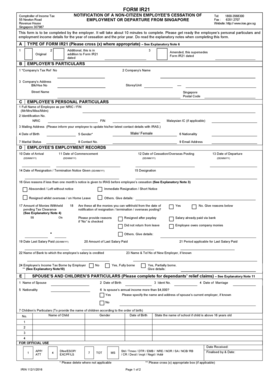

- Begin by selecting the type of form IR21 you are filling out. Indicate whether it is the original or an amended version by crossing the appropriate box.

- Enter the employer's particulars, including the company’s tax reference number, name, and address. Ensure that all information is accurate to avoid delays.

- Provide the personal particulars of the employee. This section includes the employee's full name, identification number, nationality, date of birth, gender, marital status, and contact details.

- Input the employee’s employment records. Record key dates such as the date of commencement, cessation of employment, and any relevant resignation or termination notices.

- Detail the income received or to be received during the year of cessation and the prior year. Use a calendar year basis and provide amounts for each relevant category.

- Complete the deduction section by providing details for compulsory contributions and any donations deducted through salaries.

- Fill out the declaration section, which certifies the accuracy and completeness of the provided information. Include the name and designation of the authorized personnel.

- Review the entire form to ensure all fields are correctly filled. Make any necessary adjustments before proceeding.

- Once satisfied, you can save changes, download, print, or share the completed form according to your requirements.

Start filling out your Iras form online today to ensure smooth processing of your documentation.

Individual Retirement Accounts (IRAs) Traditional IRA. Contributions typically are tax-deductible. ... Roth IRA. Contributions are made with after-tax funds and are not tax-deductible, but earnings and withdrawals are tax-free. SEP IRA. ... SIMPLE IRA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.