Loading

Get Excludible

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Excludible online

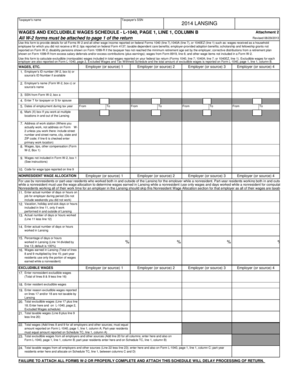

Filling out the Excludible form is essential for reporting nontaxable wages accurately on your tax return. This guide will help you navigate the form with ease, ensuring you understand each section and its requirements.

Follow the steps to complete the Excludible form online.

- Click ‘Get Form’ button to obtain the Excludible form and open it in your document editor.

- Enter the taxpayer's name and Social Security Number (SSN) at the top of the form. Ensure that you input this information accurately to avoid processing delays.

- Complete the Wages and Excludible Wages Schedule section. For each employer, provide the employer's ID number, name, and SSN. Additionally, indicate if the wages are for the taxpayer or spouse by entering 'T' for taxpayer or 'S' for spouse.

- Fill in the dates of employment for each employer. Clearly state the start and end dates for the tax year.

- If you work at multiple locations, mark the box indicating this and enter the actual work address, not merely the address from your Form W-2. Include the full address details.

- Input your wages, tips, and other compensation received during the tax year as reported on Form W-2, Box 1.

- Note any wages that are not included in Form W-2, Box 1, and provide a code for the type of wages reported.

- If you are a nonresident or part-year resident, complete the Nonresident Wage Allocation section, detailing the number of days or hours worked for each employer.

- Calculate and enter your excludible wages for both nonresidents and residents, providing the necessary reasons for their excludability.

- Total your wages, excludible wages, and taxable wages, ensuring all calculations are accurate and correctly reported on the form.

- Once all sections have been completed, save your changes. You can then download, print, or share the completed Excludible form as needed.

Start filling out your Excludible form online today to ensure accurate and timely reporting.

If you sell your certified used Honda to another private party, and your CPO Honda is still covered under warranty, the remaining warranty coverage can be transferred to the new owner. To transfer the Honda CPO warranty to the new owner, you will need to contact Honda Care® Contract Services at 1-800-999-5901.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.