Loading

Get Dhs 1125a Instructions 2004-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DHS 1125A Instructions online

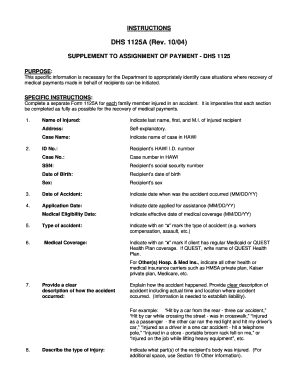

The DHS 1125A Instructions provide a structured approach for users seeking to report medical payments related to accidents. This guide will help you navigate through the form online, ensuring that you complete each section with clarity and confidence.

Follow the steps to successfully complete the DHS 1125A Instructions online.

- Press the ‘Get Form’ button to access the DHS 1125A Instructions and load the form in your online editor.

- Enter the name of the injured individual. This includes the last name, first name, and middle initial.

- Provide the address of the injured person in the designated field.

- Indicate the name of the case as it appears in the HAWI system.

- Fill in the recipient's HAWI identification number (ID No.).

- Include the case number assigned in HAWI.

- Input the recipient's social security number (SSN).

- Provide the recipient's date of birth in MM/DD/YY format.

- Mark the recipient's sex in the specified field.

- Enter the date of the accident using the MM/DD/YY format.

- Fill in the date that assistance was applied for, following the same MM/DD/YY format.

- Specify the effective date of the medical coverage, again using MM/DD/YY format.

- Select the type of accident by marking an ‘x’ in the relevant category (e.g., workers compensation, assault, etc.).

- Indicate if the recipient has regular Medicaid or QUEST Health Plan coverage, marking an ‘x’ as appropriate, and specify the name of the QUEST Health Plan if applicable.

- List all other health or medical insurance carriers that may provide coverage for the recipient.

- Provide a detailed description of how the accident occurred, including time and location.

- Describe the type of injury sustained by the recipient and specify the affected body parts.

- Indicate the extent of the recipient’s injuries (serious, slight, etc.).

- List the names of doctors, hospitals, laboratories, and other medical professionals who treated or examined the recipient.

- State whether the recipient is still under medical care for their injury by marking ‘YES’ or ‘NO’.

- List names of individuals or property owners who may be at fault in the accident and include their insurance companies.

- Provide details of the insurance companies and policy numbers for those potentially at fault.

- Indicate if the recipient intends to file a lawsuit by marking either ‘YES’ or ‘NO’.

- If applicable, provide the date when the suit was settled.

- Enter the name, address, and telephone number of the recipient’s attorney(s).

- Indicate whether the recipient had any insurance at the time of the accident, and provide details if applicable.

- Specify if the recipient was driving or a passenger in their own vehicle during the incident.

- If applicable, indicate whether the recipient was driving or a passenger in a borrowed vehicle.

- Mark if the recipient was injured as a pedestrian or in another situation, and provide details.

- If a police report exists, indicate ‘Yes’ and provide the report number; otherwise, mark that none is available.

- Use the additional space provided to include any other pertinent information about the accident.

- Complete the final section with the name of the worker, the current date, section/unit information, and a contact phone number.

Complete your documents online now for efficient processing.

Ordering tax forms and instructions can be easily done online or by contacting your local tax office. The IRS website often provides downloadable options for convenience. For specific forms like those related to the DHS 1125A Instructions, make sure you check available resources on the uslegalforms platform to access everything you need efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.