Loading

Get Crs Self Certification Form Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crs Self Certification Form Template online

Filling out the Crs Self Certification Form Template is essential for tax compliance. This guide provides step-by-step instructions for completing the form online to ensure accuracy and efficiency.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to access the form and open it in the editor.

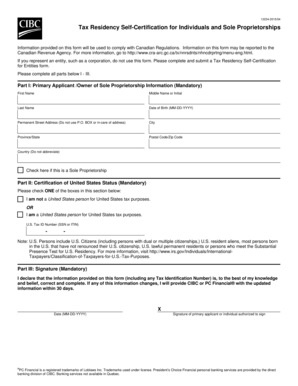

- Begin with Part I: Primary Applicant/Owner of Sole Proprietorship Information. Fill in your first name, middle name or initial, and last name. Ensure that you also provide your date of birth in the MM-DD-YYYY format.

- If you are operating as a sole proprietorship, check the appropriate box indicating this status.

- Proceed to Part II: Certification of United States Status. You must check one of the boxes. Indicate whether you are or are not a United States person for tax purposes. If applicable, include your U.S. Tax ID Number (SSN or ITIN) in the provided format.

- For Part III: Signature, declare that the information you provided is correct and complete. If any information changes, you are obligated to update it within 30 days. Finally, sign the form and date it in the MM-DD-YYYY format.

- Once you have completed all sections, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete the Crs Self Certification Form Template online today to ensure your tax information is accurately reported.

A CRS self-certification form is a form to be obtained from an account holder to certify the tax residency status of the account holder and its CRS reporting status. The account holder is responsible for accurately completing the CRS self- certification form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.