Loading

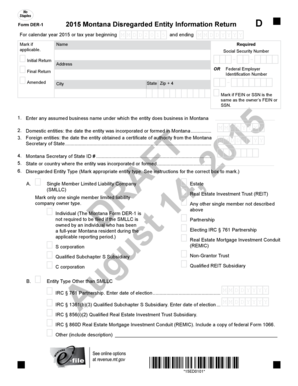

Get No Staples Form Der-1 2015 Montana Disregarded Entity - Revenue Mt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the No Staples Form DER-1 2015 Montana Disregarded Entity - Revenue Mt online

Filling out the No Staples Form DER-1 2015 is an important task for business entities categorized as disregarded for tax purposes in Montana. This guide will provide a comprehensive walkthrough on how to efficiently complete the form online, ensuring you understand each section and the required information.

Follow the steps to successfully complete the No Staples Form DER-1 online.

- Click the 'Get Form' button to access the No Staples Form DER-1 2015 and open it in your preferred editor.

- Provide the necessary details at the top of the form, including the name, address, and identification number (SSN or FEIN) of the disregarded entity.

- Indicate by marking the appropriate boxes if the form is an initial return, final return, or amended return.

- For lines related to the entity formation, specify if it is a domestic or foreign entity by completing the respective lines based on your entity's status.

- Mark the box corresponding to the type of disregarded entity, ensuring to select only one option that describes your entity accurately.

- Complete the sections concerning income tax withholding, including details for Montana mineral royalty taxes and any adjustments. Make sure to add any amounts owed or overpaid as indicated.

- Fill out the direct deposit information if you are opting for a refund via bank transfer. Include your routing number and account number accurately.

- Review that all required fields are accurately filled in and the necessary calculations are performed correctly.

- Once all fields are completed, save your changes. You may choose to download, print, or share the form as needed.

Start filling out your No Staples Form DER-1 2015 online today to ensure timely and accurate filing.

Related links form

A disregarded entity is a business entity that is disregarded for federal income tax purposes. Instead, income from the business is included on its owner's income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.