Loading

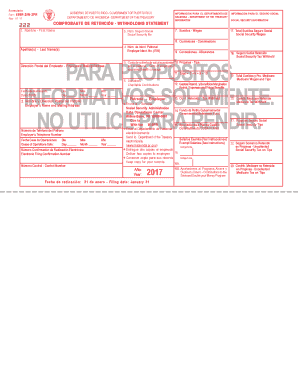

Get Form 499r-2/w-2pr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 499R-2/W-2PR online

Filling out the Form 499R-2/W-2PR correctly is essential for reporting wages and tax withholdings in Puerto Rico. This guide provides clear, step-by-step instructions to help you navigate the process with ease, ensuring that you complete the form accurately online.

Follow the steps to complete your Form 499R-2/W-2PR online.

- Press the ‘Get Form’ button to obtain the Form 499R-2/W-2PR and open it in your preferred digital editor.

- Enter your personal information in the designated fields. Start with your first and last name, followed by your date of birth. Ensure that the information you provide is accurate.

- Fill in your Social Security number and your employer's identification number (EIN) in the respective fields to ensure proper identification.

- Provide your employer's name and mailing address. This information is necessary for communication and record-keeping.

- Enter the employee's mailing address to ensure that all correspondence related to your tax information can be directed appropriately.

- Complete the wage sections by entering your total wages, commissions, allowances, tips, and any other relevant income figures. Be sure to follow any instructions regarding exempt salaries.

- Include the amounts withheld for Social Security and Medicare taxes as indicated in the form. This will ensure that your withholdings are correctly reported.

- Review all entered information for accuracy. This step is crucial to prevent any delays or issues with tax filing.

- Save your changes in the document, and proceed to download, print, or share your completed form as per your requirements.

Ensure your tax documentation is complete by filing your Form 499R-2/W-2PR online today.

If the employee is claiming MARRIED FILING SEPARATELY, multiply the total number of dependents claimed by $1,250 each....Withholding Formula (Residents) (Effective Pay Period 06, 2017) Taxable WagesAmount of TaxOver $41,500 but not over $61,50025% minus $6,945Over $61,50033% minus $11,8653 more rows • Mar 21, 2018

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.