Loading

Get Garnishment Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Garnishment Worksheet online

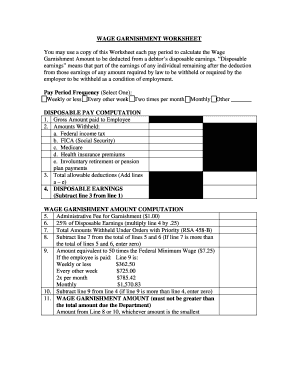

The Garnishment Worksheet is a crucial tool for calculating the wage garnishment amount to be deducted from an individual's disposable earnings. This guide will walk you through each component of the form, ensuring a clear understanding for users with varying levels of experience.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the Garnishment Worksheet and open it in your preferred online editor.

- Select your pay period frequency by choosing one option from the provided list: weekly or less, every other week, two times per month, monthly, or other.

- Enter the gross amount paid to the employee in the designated section for Gross Amount Paid to Employee.

- Record all amounts withheld from the employee's earnings. Detail each item such as federal income tax, FICA (Social Security), Medicare, health insurance premiums, and involuntary retirement or pension plan payments.

- Calculate the total allowable deductions by adding up the amounts from step 4a through step 4e and input this total.

- Determine the disposable earnings by subtracting the total allowable deductions from the gross amount entered in step 3.

- To compute the wage garnishment amount, first list the administrative fee for garnishment, which is $1.00.

- Calculate 25% of the disposable earnings from step 6 and record this amount.

- Add the total amounts withheld under orders with priority and then subtract this total from the sum of the amounts listed in steps 7 and 8. If this results in a negative value, enter zero.

- Calculate the amount equivalent to 50 times the Federal Minimum Wage, based on the frequency of payment determined in step 2.

- Subtract the value from step 10 from the disposable earnings. If the result is negative, enter zero.

- Finally, determine the wage garnishment amount. This must not exceed the total amount due to the department, selecting the smallest value from step 9 or 11.

- Once all fields are filled out, save your changes, and proceed to download, print, or share the completed form as necessary.

Start filling out the Garnishment Worksheet online today!

Settling a debt requires that you have some leverage. ... Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement. At this point, the creditor has sufficiently proven the debt is valid and the court has ordered you to repay it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.