Loading

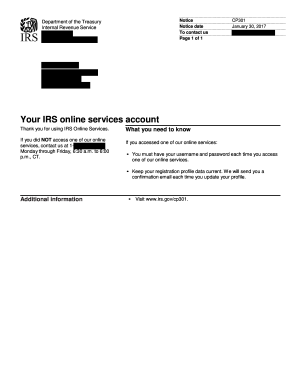

Get Irs Gov Cp301

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Gov CP301 online

Filling out the IRS Gov CP301 form online is a straightforward process that ensures you manage your IRS online services account effectively. This guide provides you with clear, step-by-step instructions to successfully complete the form.

Follow the steps to fill out the IRS Gov CP301 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your username and password to access your IRS online services account. Make sure to have these credentials ready each time you log in.

- Review your registration profile data. Ensure that all information, including your email address, is accurate and current.

- If you make any changes to your profile, save the changes and confirm that you receive an email from the IRS, verifying the updates you've made.

- Once all information is verified and updated, you can choose to save your changes, download the form, print it, or share it as needed.

Complete your IRS documents online today for seamless processing.

Related links form

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.