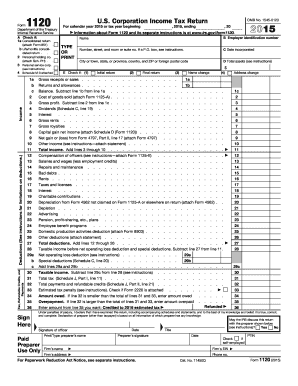

Get IRS 1120 2015

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120 online

How to fill out and sign IRS 1120 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If you aren?t associated with document managing and law processes, filling in IRS forms can be extremely difficult. We comprehend the value of correctly completing documents. Our online software offers the utility to make the mechanism of processing IRS docs as simple as possible. Follow this guideline to quickly and accurately fill in IRS 1120.

The best way to submit the IRS 1120 on-line:

-

Click on the button Get Form to open it and begin editing.

-

Fill in all needed lines in the file making use of our powerful PDF editor. Switch the Wizard Tool on to finish the process much easier.

-

Ensure the correctness of filled info.

-

Add the date of filling IRS 1120. Use the Sign Tool to make an individual signature for the file legalization.

-

Complete editing by clicking on Done.

-

Send this record straight to the IRS in the most convenient way for you: through email, using digital fax or postal service.

-

You can print it on paper if a copy is required and download or save it to the preferred cloud storage.

Using our service can certainly make skilled filling IRS 1120 a reality. make everything for your comfortable and simple work.

How to edit IRS 1120: customize forms online

Have your stressless and paper-free way of working with IRS 1120. Use our reliable online solution and save tons of time.

Drafting every document, including IRS 1120, from scratch requires too much effort, so having a tried-and-tested platform of pre-uploaded form templates can do wonders for your efficiency.

But working with them can be struggle, especially when it comes to the documents in PDF format. Fortunately, our huge catalog includes a built-in editor that enables you to quickly fill out and customize IRS 1120 without the need of leaving our website so that you don't need to lose time executing your documents. Here's what you can do with your form using our tools:

- Step 1. Find the required form on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Take advantage of professional editing tools that let you add, remove, annotate and highlight or blackout text.

- Step 4. Generate and add a legally-binding signature to your form by using the sign option from the top toolbar.

- Step 5. If the document layout doesn’t look the way you want it, use the tools on the right to remove, put, and re-order pages.

- step 6. Insert fillable fields so other persons can be invited to fill out the document (if applicable).

- Step 7. Pass around or send the document, print it out, or select the format in which you’d like to download the file.

Whether you need to execute editable IRS 1120 or any other document available in our catalog, you’re on the right track with our online document editor. It's easy and secure and doesn’t require you to have particular tech background. Our web-based tool is set up to handle virtually everything you can think of concerning file editing and execution.

Forget about the outdated way of handling your documents. Go with a a professional option to help you streamline your activities and make them less reliant on paper.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing Form

FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 1120

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.