Loading

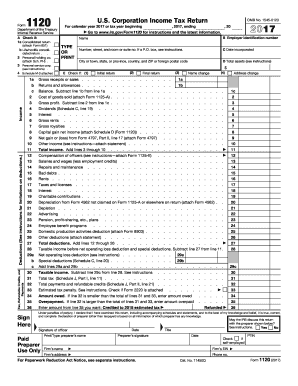

Get Irs 1120 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 online

Filling out the IRS 1120 form online can seem daunting, but with this user-friendly guide, you will navigate each section with ease. This guide provides clear, step-by-step instructions tailored to your needs, ensuring you accurately complete your corporation's income tax return.

Follow the steps to effectively complete the IRS 1120 online.

- Click ‘Get Form’ button to obtain the IRS 1120 form and open it for editing.

- Enter the relevant tax year at the top of the form. For example, specify '2017' if that is the tax year you are filing for. This applies to line 'For calendar year' section.

- Fill out the corporate name and employer identification number (EIN) in the designated fields. Ensure all information is accurate to avoid processing delays.

- Complete the ‘Date incorporated’ section with the exact incorporation date of your corporation. This information is crucial for tax calculations.

- Provide the corporation's total assets in the specified field to give the IRS an overview of your corporation’s financial status.

- Utilize the 'Total income' section by entering values based on your corporation's revenue streams, including gross receipts, dividends, and any other income types listed.

- In the deductions section, carefully gather and enter all applicable deductions. This includes expenses like salaries, rent, and advertising costs. Proper documentation may be required.

- Review the 'Taxable income' section where you will subtract total deductions from total income. This is a critical step to determine tax liability.

- Complete the tax computation in Schedule J, ensuring you account for any credits due. This will impact the final tax amount owed or the refund.

- Finalize the form by ensuring you or an authorized officer signs and dates the document, affirming its accuracy and completeness.

- Upon completing the form, you can save your changes, download a copy, print it, or share it as needed for your records or submission.

Start filling out the IRS 1120 online to ensure timely and accurate tax filing for your corporation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To calculate net income on Form 1120 S, sum all your business revenues and subtract allowable business expenses. Ensure you include all direct costs of goods sold and operating expenses. Precise records help in this calculation, and the UsLegalForms platform offers resources that can assist in accurately completing your 1120 S form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.