Loading

Get 7(a) Risk Based Lender Review File Checklist Loan Name Sba Loan Number Lender Name Approval Date

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 7(a) Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date online

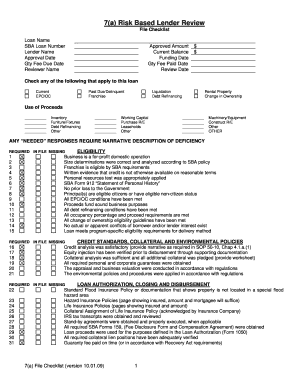

Filling out the 7(a) Risk Based Lender Review File Checklist is an essential process for lenders to review various aspects of SBA loans. This guide provides step-by-step instructions to ensure accuracy and completeness in conducting your online submission.

Follow the steps to efficiently complete your checklist.

- Click ‘Get Form’ button to obtain the form and open it in your digital document manager.

- Begin by entering the loan identification details in the appropriate fields: Loan Name, SBA Loan Number, Lender Name, and Approval Date. Ensure these are accurately filled to represent the loan being reviewed.

- Next, provide information on the 'Gty Fee Due Date', 'Reviewer Name', 'Approved Amount', 'Current Balance', 'Funding Date', and 'Gty Fee Paid Date'. Review your entries for any mistakes before proceeding.

- In the sections for loan status and purposes, indicate the applicable options such as Current, Past Due/Delinquent, or specific categories under Use of Proceeds. Fill in any necessary details as required.

- If any ‘needed’ responses apply, describe the deficiencies in the provided narrative fields, for documentation purposes. Ensure clarity and thoroughness in your explanations.

- Address the sections on Credit Standards, Collateral, and Environmental Policies by providing narrative evidence as required. Make sure all supporting documentation is included.

- Confirm eligibility criteria by responding to all statements regarding business operations, credit availability, and compliance with SBA requirements.

- Complete the Loan Authorization, Closing, and Disbursement section by uploading necessary documents such as flood insurance and tax transcripts, while verifying all signatures are in place.

- Finalize the document by reviewing each section for completeness. Ensure there are no missing fields before saving your progress.

- You can now save changes, download the completed checklist, print it for your records, or share it as necessary.

Get started and complete your 7(a) Risk Based Lender Review File Checklist online today!

A score of 5 is given to the best risk performers, with a 1 to the worst.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.