Loading

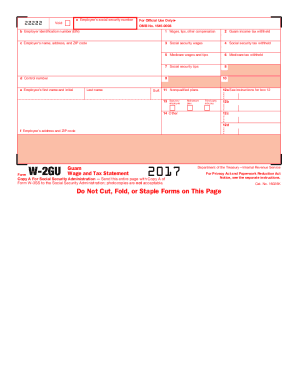

Get Irs W-2gu 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2GU online

Filling out the IRS W-2GU form online can be straightforward when you understand the components and steps involved. This guide will provide you with clear and supportive instructions to help you accurately complete the Guam Wage and Tax Statement.

Follow the steps to fill out the IRS W-2GU online.

- Click the ‘Get Form’ button to obtain the W-2GU online and open it in your editor.

- Enter the employee’s social security number in box 'a'. This is a mandatory field necessary for tax identification.

- In box 'b', input the employer identification number (EIN). This number is essential for the IRS to identify the employer.

- Fill out the employer's name, address, and ZIP code in box 'c'. This information should appear exactly as registered with the IRS.

- In box '1', enter total wages, tips, and other compensation paid to the employee during the tax year.

- Report any Guam income tax withheld in box '2'. This applies to employees subject to Guam income tax.

- Complete box '3' with total social security wages and box '4' with the total social security tax withheld.

- Enter Medicare wages and tips in box '5', followed by the Medicare tax withheld in box '6'.

- In box '7', report any social security tips that were included in the employee's compensation.

- Utilize boxes '8' and '9' for additional information if needed or leave them blank as applicable.

- Fill in the employee’s first name, initial, and last name in box 'e'. Ensure accuracy to avoid discrepancies.

- Enter the employee’s address and ZIP code in box 'f'. This ensures proper delivery of tax documents.

- Complete any applicable boxes for codes in section 12 related to retirement plans or other benefits.

- After reviewing the completed form for accuracy, save your changes, and choose to download, print, or share the form as needed.

Complete your IRS W-2GU form online today for efficient and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Typically, your employer fills out your IRS W-2GU based on your earnings and tax withholdings for the year. You should receive this form at the end of January. While you don’t fill it out yourself, it’s vital to review it for accuracy. Report any discrepancies to your employer promptly to avoid tax filing issues.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.