Loading

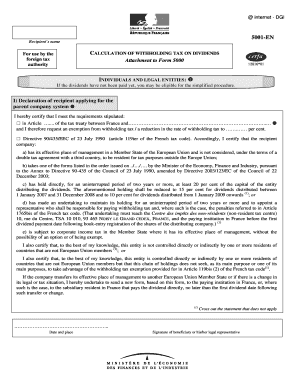

Get Internet - Dgi 5001-en Recipient S Name Calculation Of Withholding Tax On Dividends For Use By The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Internet - DGI 5001-EN Recipient S Name Calculation of Withholding Tax on Dividends online

This guide provides straightforward instructions for filling out the Internet - DGI 5001-EN Recipient S Name Calculation of Withholding Tax on Dividends form online. It is designed to assist users in correctly completing the form to ensure accurate tax withholding on dividends.

Follow the steps to effectively complete the form online.

- Click ‘Get Form’ button to access the form and launch it in your preferred viewer.

- In Section I, provide the necessary declarations regarding your eligibility for the parent company system. Certify compliance with the relevant articles of the tax treaty and outline your request for withholding tax exemption or reduction.

- Complete the declaration about the recipient's details, ensuring that you check the appropriate boxes to confirm the conditions met under Directive 90/435/EEC, including the effective place of management, holding percentages and periods.

- Fill out the required information about the dividend paying company. Include the exact name and address of the French company, along with the dividend payment date.

- Input the number of shares held and the percentage of shareholding in the designated fields to calculate the total dividends.

- Calculate the total withholding tax under domestic legislation and the withholding tax due under the applicable tax treaty. Be sure to use the provided formulas correctly.

- In the final view, verify that all fields are accurately completed. You can now save changes, download, print, or share the completed form as needed.

Begin completing your Internet - DGI 5001-EN form online today for an efficient tax process.

Ordinary dividend distributions are subject to a 15% U.S. withholding tax. Long-term capital gain distributions are not subject to U.S. withholding tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.