Get Texas Employer New Hire Reporting Form Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Employer New Hire Reporting Form Fillable online

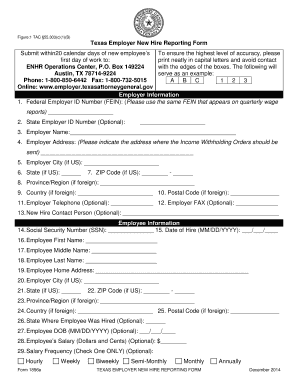

The Texas Employer New Hire Reporting Form helps employers meet their reporting obligations for new hires. This guide offers clear and supportive instructions on how to fill out the form accurately online.

Follow the steps to complete the Texas Employer New Hire Reporting Form online.

- Press the ‘Get Form’ button to access the Texas Employer New Hire Reporting Form and open it in your chosen tool.

- Begin with the Employer Information section. Fill in the Federal Employer ID Number (FEIN) in Box 1, ensuring it is the same as reported on quarterly wage reports.

- Complete Box 2 with the optional State Employer ID Number if applicable. Enter the Employer Name in Box 3 as it appears on the employee's W-4 form.

- In Box 4, provide the Employer Address, ensuring it is the location where Income Withholding Orders should be sent. Avoid listing more than one address.

- Optionally, enter the Employer Telephone and FAX numbers in Boxes 11 and 12, and include a New Hire Contact Person's name in Box 13 to enhance communication.

- Proceed to the Employee Information section. Input the employee's Social Security Number (SSN) in Box 14 and the Date of Hire in Box 15, using the format MM/DD/YYYY.

- Fill in Boxes 16 to 18 with the employee's first, middle, and last names, then provide their Home Address in Box 19.

- Again, complete Boxes 20 to 22 with the Employee City, State, and ZIP Code for domestic employees or Boxes 23 to 25 for those residing outside the U.S.

- If applicable, indicate the State Where Employee Was Hired in Box 26, followed by their Date of Birth in Box 27, and Salary in Box 28.

- In Box 29, check the appropriate box to indicate the employee’s salary frequency.

- Once all fields are completed, save your changes. You may then download, print, or share the form as required.

Complete your Texas Employer New Hire Reporting Form online to ensure compliance with reporting requirements.

Related links form

Federal employers report New Hire data directly to the National Directory of New Hire.

Fill Texas Employer New Hire Reporting Form Fillable

Texas Employer New Hire Reporting Form. Submit within 20 calendar days of new employee's first day of work to: Central File Maintenance. The following forms relating to New Hire Reporting are available. Employers must report new hires and rehires within 20 calendar days of the hire date. Federal and state law requires employers to report new hires and rehires within 20 calendar days from the date the employee starts earning wages. Submit within 20 calendar days of new employee's first day of work to: ENHR Operations Center, P.O. Box 149224. Demographic and Administrative Forms for New Employees. Form Number (if applicable), Form Description. It requires specific employer and employee information, including Federal Employer ID Number, employee Social Security Number, and salary details. The Texas New Hire Reporting Form serves as a crucial tool for employers to comply with state reporting requirements for new employees.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.