Loading

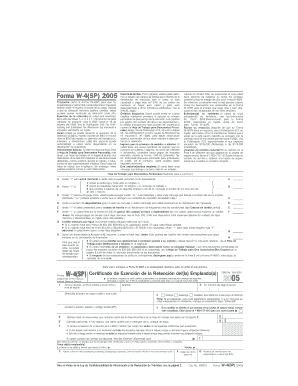

Get Irs W-4(sp) 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-4(SP) online

The IRS W-4(SP) form is essential for determining the correct amount of federal income tax withholding from your pay. Understanding how to accurately complete this form online can ensure that your withholding aligns with your tax obligations.

Follow the steps to complete the IRS W-4(SP) form online.

- Use the ‘Get Form’ button to access the IRS W-4(SP) and open it in the editor.

- Enter your personal information, including your first name, middle initial, last name, and your social security number in the designated fields.

- Indicate your filing status by checking the appropriate box: single or married. If applicable, specify if you are married but withholding at the higher single rate.

- Complete the exemption certification if you qualify. Fill out only lines 1, 2, 3, 4, and 7, and be sure to sign the form to validate it.

- If you are not exempt, complete the Personal Exemption Worksheet found on the second page to determine how many personal allowances to claim.

- Record the total from the worksheet in the section for total exemptions on line 5.

- If applicable, include any additional amount you wish to have withheld from each paycheck in the corresponding field.

- Review all entries for accuracy before saving your form.

- Save your completed form, and choose whether to download, print, or share it with your employer.

Complete your IRS W-4(SP) form online today to ensure accurate withholding.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Deciding whether to put a 1 or 0 on your IRS W-4(SP) depends on your personal financial situation. Claiming 1 allows for less tax to be withheld, which might be beneficial if you plan to have more deductions come tax time. Meanwhile, claiming 0 ensures that more is withheld, which could prevent an unexpected tax bill. Uslegalforms can help you understand the implications of your choice.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.