Loading

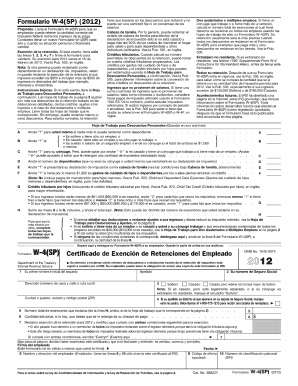

Get Formulario W 4sp 2012 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario W 4sp 2012 online

Filling out the Formulario W 4sp 2012 is a straightforward process when done online. This guide will provide you with clear, step-by-step instructions to ensure accurate completion of the form.

Follow the steps to complete the Formulario W 4sp 2012 effortlessly.

- Click the ‘Get Form’ button to access the Formulario W 4sp 2012 and open it in your chosen editor.

- Begin with Section 1, where you will enter your personal information. This typically includes your name, address, and taxpayer identification number. Ensure all details are accurate to avoid processing issues.

- Move on to Section 2, where you will provide information about your filing status. Review the options carefully and select the one that best reflects your situation.

- In Section 3, you will indicate additional information regarding your tax situation, such as any adjustments or special circumstances that may affect your withholding.

- Once you have completed all necessary sections, review your entries for accuracy and completeness.

- Save your changes and choose to download, print, or share the completed form as needed.

Begin filling out your Formulario W 4sp 2012 online today for a streamlined experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you do not fill out a W4P, your payer will typically withhold taxes at the default rate, which may not be ideal for your financial position. This can lead to over-withholding, resulting in a potential refund, or under-withholding, which may leave you with a tax bill. It is advisable to complete this form to ensure your withholding aligns with your financial goals. Utilize Formulario W 4sp 2012 as a reference to help you navigate this process effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.