Loading

Get Contribution And Wage Adjustment Report (modes-4a)pdf ... - Labor Mo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Contribution And Wage Adjustment Report (MODES-4A)PDF - Labor Mo online

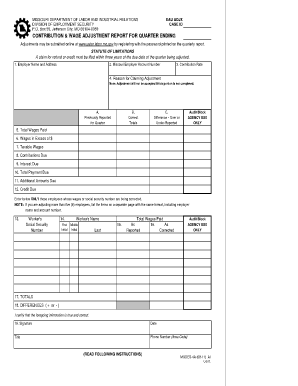

Filing the Contribution And Wage Adjustment Report (MODES-4A) is an important task for employers needing to adjust wage and contribution data from previous reports. This guide provides clear, step-by-step instructions tailored to assist users of all experience levels in successfully completing the form online.

Follow the steps to accurately complete your report online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter the ending date of the calendar quarter for which you are filing the report at the top of the form.

- Provide your employer name and address, ensuring that the information is typed or printed clearly.

- Input your 14-digit Missouri Division of Employment Security employer account number accurately.

- Record the contribution rate applicable for the calendar quarter you are adjusting.

- Fill in the details supporting your claim for adjustment, explicitly stating why the wages were reported in error.

- Complete items five through twelve first by entering the totals previously reported, the correct totals, and the differences between them in their respective columns.

- If applicable, enter total wages paid for employees, including the corrected and reported amounts for each individual listed in the appropriate fields.

- Ensure total calculations are accurate, including summing the totals and differences where necessary.

- Sign and date the form, providing your title and contact phone number in the designated section.

- If adjusting more than five employees, prepare a separate page following the same format with required details.

- After reviewing and confirming all information is correct, save changes, and download or share the completed form as needed.

Complete your Contribution And Wage Adjustment Report online with confidence today.

New employers pay 2.511%, or 1% if you're a nonprofit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.