Loading

Get Ct-941(drs/p), Connecticut Reconciliation Of Withholding ... - Ct.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT-941(DRS/P), Connecticut Reconciliation Of Withholding online

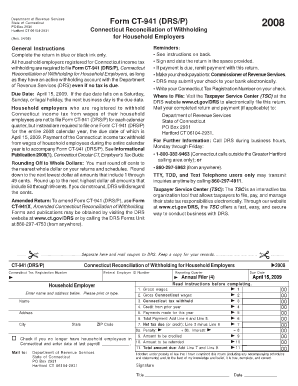

This guide provides a comprehensive overview of how to effectively fill out the CT-941(DRS/P), Connecticut Reconciliation Of Withholding form. Designed for household employers, this step-by-step guide will simplify the process, ensuring accuracy and compliance.

Follow the steps to complete the CT-941(DRS/P) form online.

- Press the ‘Get Form’ button to access the CT-941(DRS/P) form and open it in your preferred editor.

- Enter your Connecticut Tax Registration Number at the designated field, ensuring accuracy.

- For Line 1, input the total gross wages paid to all household employees during the calendar year.

- On Line 2, report the total Connecticut wages paid, which includes wages for resident employees and non-resident employees working in Connecticut.

- For Line 3, enter the total amount of Connecticut income tax withheld from wages during the year.

- On Line 4, include the amount credited from the prior year’s return, adjusted for any amounts that were withheld and not repaid.

- Line 5 requires the total payments made for the year, which should encompass all relevant payments to be reported.

- Calculate the total payment on Line 6 by adding the amounts from Line 4 and Line 5.

- For Line 7, subtract the total from Line 6 from the total tax withheld reported on Line 3 to determine the tax due or credit.

- If applicable, calculate and enter penalties on Line 8a and interest on Line 8b. Sum these amounts on Line 8.

- Enter the amounts to be credited (Line 9) or refunded (Line 10) based on the calculations from Line 7.

- Complete Line 11 if there is a net tax due by adding any additional amounts from Line 7 and Line 8.

- Finally, review all entries for accuracy. Save changes, then download or print the completed form for your records.

Start filling out your CT-941(DRS/P) form online today to ensure timely and accurate filing.

Withholding is the money an employer withholds from each employee's wages to help prepay the state income tax of the employee. ... Wages of a nonresident are subject to Connecticut income tax withholding if the wages are paid for services performed in Connecticut.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.