Loading

Get Ar4p Employee's Withholding Certificate For ... - State Of Arkansas - Dfa Arkansas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

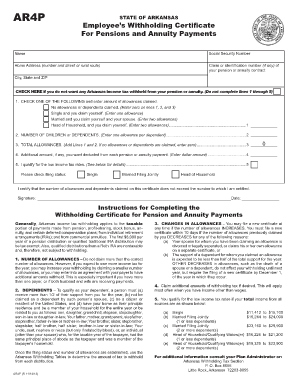

How to fill out the AR4P Employee's Withholding Certificate for pensions and annuity payments online

Filling out the AR4P Employee's Withholding Certificate is essential for users receiving pensions or annuity payments in Arkansas. This guide will provide clear step-by-step instructions to help you navigate the form efficiently, ensuring proper withholding of state income tax based on your individual circumstances.

Follow the steps to complete your withholding certificate online.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Begin by entering your name, Social Security number, and home address in the designated fields. Ensure that all information is accurate and matches your official documents.

- Input your claim or identification number for your pension or annuity contract, if applicable. This information helps to link your form to your specific payment.

- If you prefer not to have any Arkansas income tax withheld from your pension or annuity, check the box provided. If you select this option, you do not need to fill out lines 1 through 5.

- Determine the number of allowances you wish to claim. Check the appropriate option and enter the relevant number of allowances on line 1. This choice influences the amount of tax withheld.

- List the number of dependents you have. For each dependent, claim one allowance on line 2. This includes children or other individuals whom you support.

- Calculate the total allowances by adding the values from lines 1 and 2. Enter this total on line 3. If you are not claiming any allowances or dependents, enter zero.

- If you wish to have an additional amount withheld from your pension or annuity payments, specify that amount on line 4.

- If you qualify for low-income tax rates, indicate this on line 5 as per the provided criteria.

- Choose your filing status by marking the appropriate checkbox for Single, Married Filing Jointly, or Head of Household.

- Sign and date the form to certify that the information is correct and that your allowances do not exceed the entitled amount.

Complete the AR4P Employee's Withholding Certificate online and ensure your pension or annuity payments are accurately processed.

The general default requires employers to withhold state taxes in the state where the work is performed by the employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.