Loading

Get Georgia Form It 550

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Georgia Form IT-550 online

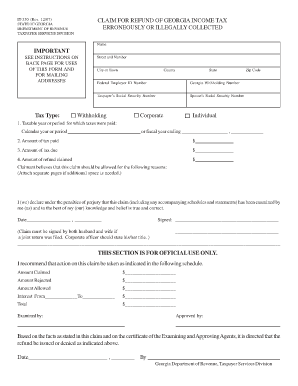

Filling out the Georgia Form IT-550 online can streamline the process of claiming a refund for erroneously or illegally collected income taxes. This guide aims to provide clear and concise instructions for users of all backgrounds to complete this important form accurately.

Follow the steps to complete the Georgia Form IT-550 online.

- Click the 'Get Form' button to obtain the form and open it in your preferred editing tool.

- Enter your name in the designated field at the top of the form. This should be the name of the person or entity submitting the claim.

- Fill in your street address, city or town, county, state, and zip code in the appropriate fields.

- Provide your Georgia withholding number and your taxpayer's Social Security number. If applicable, include your spouse's Social Security number as well.

- Select the tax type by checking the corresponding box for withholding, corporate, or individual.

- Indicate the taxable year or period for which taxes were paid by choosing either "calendar year" or "fiscal year ending" and providing the relevant year.

- Enter the amount of tax paid, amount of tax due, and the amount of refund claimed in the designated fields.

- In the section labeled 'Claimant believes that this claim should be allowed for the following reasons', provide a detailed explanation of your claim. If you need more space, you can attach additional pages.

- Sign and date the form. If a joint return was filed, both partners must sign. For entities, the corporate officer must sign and include their title.

- Review the completed form for accuracy and completeness before submitting it. You may save changes, download, print, or share the form as needed.

Start completing your documents online today!

Single tax filers and married people who file separately will get $250. Head of household filers will get $375 and married people who file joint returns will get $500 based on an individual or couple's tax liability. Most refunds will be issued by July 1, as long as you file your taxes on or before April 18.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.