Loading

Get A4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A4 Form online

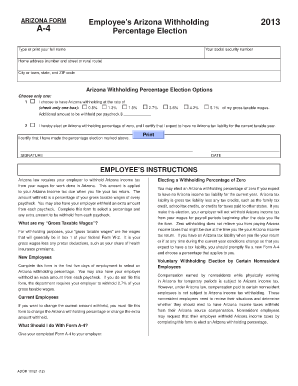

This guide provides a step-by-step approach for users to fill out the A4 Form online, ensuring clarity and understanding throughout the process. Follow the instructions carefully to comply with Arizona withholding requirements.

Follow the steps to complete your A4 Form online effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Type or print your full name in the designated field to identify yourself clearly.

- Enter your social security number in the appropriate box to ensure correct tax documentation.

- Fill in your home address, including the number and street or rural route, city or town, state, and ZIP code for accurate correspondence.

- In the Arizona Withholding Percentage Election Options section, choose only one percentage for withholding from your gross taxable wages by checking the appropriate box.

- If you wish to have an additional amount withheld from each paycheck, enter that amount in the provided field.

- If you expect no Arizona tax liability for the current taxable year, you may elect a withholding percentage of zero by marking the corresponding option.

- Review your selections carefully and ensure all information is correct.

- Sign the form in the signature field to validate your selections and date it to indicate when you filled it out.

- Once completed, save your changes, download a copy for your records, or print the form to provide to your employer.

Take action today by filling out your A4 Form online to ensure proper withholding.

6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2020 is $137,700 (up from $132,900 in 2019).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.