Loading

Get Schedule P 541 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule P 541 Form online

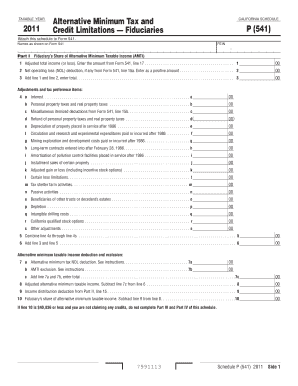

Completing the Schedule P 541 form is a vital step for fiduciaries managing alternative minimum tax and credit limitations in California. This guide provides clear, step-by-step instructions to help users fill out the form online with confidence.

Follow the steps to successfully complete the Schedule P 541 Form online.

- Use the ‘Get Form’ button to obtain the Schedule P 541 Form and open it in your online editor.

- Enter the names as shown on Form 541 and your Federal Employer Identification Number (FEIN) at the top of the form.

- In Part I, starting with line 1, input the adjusted total income or loss from Form 541, line 17. Continue to complete lines 2 and 3 by following the instructions provided.

- For line 4, carefully list all adjustments and tax preference items, such as interest, property taxes, and other relevant deductions. Ensure to enter positive amounts where necessary.

- After completing adjustments on line 5, move to line 6 and add the total from line 3 to line 5 to determine your alternative minimum taxable income.

- In Part II, begin by entering your adjusted alternative minimum taxable income on line 1. Follow through with lines 2 to 15, providing necessary deductions and income distribution details.

- Next, complete Part III by calculating your tentative minimum tax. Begin with line 1, using your figure from Part I, line 10, and proceed through to line 10 according to the computations required.

- In Part IV, document any credits that reduce your tax. Fill in the lines based on the provided credit types and amounts, ensuring all relevant forms are attached to Form 541.

- Finally, review all entries for accuracy. Save your changes, and then choose to download, print, or share the completed Schedule P 541 Form as needed.

Start filling out your Schedule P 541 Form online today for a smoother tax filing experience.

The fiduciary (or one of the fiduciaries) must file Form 541 for a decedent's estate if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $1,000. An alternative minimum tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.