Loading

Get Cp504

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cp504 online

The Cp504 form is an important document that helps facilitate communication with the IRS regarding your tax obligations. This guide will provide you with a clear, step-by-step approach to filling out the form online, ensuring you understand each section and can complete it accurately.

Follow the steps to effectively complete the Cp504 form online.

- Click ‘Get Form’ button to access the Cp504 and open it in your preferred editor.

- Begin by entering your personal information. This includes your name, address, and taxpayer identification number. Ensure that all entered data is accurate to avoid processing delays.

- Provide details about your tax return. Indicate the tax year and any relevant filings that this form pertains to. This helps in properly categorizing your request.

- Complete the sections that outline your current financial status. This may involve disclosing your income and any assets that may contribute to your financial overview.

- If the form requires additional information or documentation, make sure to attach those files as specified. Look for any prompts that indicate required fields and ensure that you fulfill them.

- Review all sections carefully to ensure that there are no errors or omissions. A thorough check can prevent potential issues in processing your form.

- Once you have completed the form, save your changes. You may also download it for your records or print it out if needed. Ensure to share the form with relevant parties as necessary.

Start completing your Cp504 form online to ensure timely communication with the IRS.

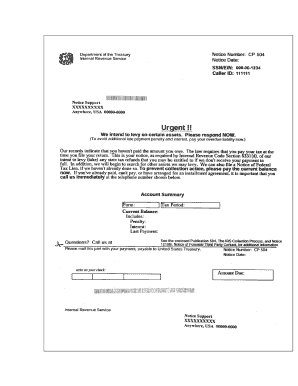

The Notice CP504 (also referred to as the Final Notice) is mailed to you because the IRS has not received payment of your unpaid balance and tells you how much you owe, including additional penalties and interest, when it's due, and how to pay before further collection action takes place.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.