Loading

Get 2010 Ic-145 Instructions For 2010 Form 4n. 2010 Ic-145 Form 4n Instructions - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 IC-145 Instructions For 2010 Form 4N online

This guide provides users with clear and comprehensive instructions on how to complete the 2010 IC-145 Instructions For 2010 Form 4N. It is designed for a broad audience, ensuring that even those with limited legal experience can successfully fill out the form.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

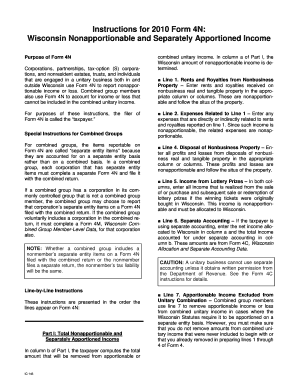

- Begin by reviewing the purpose of Form 4N, which is for corporations, partnerships, and other entities engaged in a unitary business within and outside Wisconsin to report nonapportionable income or loss.

- In Part I, compute your total nonapportionable and separately apportioned income. Fill in column a for Wisconsin amounts and column b for total amounts, carefully following the line instructions. Start with rents and royalties, entering appropriate income on Line 1.

- On Line 2, input any expenses related to the income entered on Line 1, ensuring they are also nonapportionable.

- For Line 4, report any profits or losses from the disposal of nonbusiness property in the corresponding columns.

- On Line 5, enter income from lottery prizes purchased within Wisconsin.

- Complete Line 6 if using separate accounting, detailing net Wisconsin income and total income under separate accounting.

- Use Line 7 to exclude any apportionable income as required, ensuring prior removal of already excluded items from the unitary income on Form 4.

- Proceed to Part II to determine your Wisconsin share of apportionable income excluded from the unitary combination.

- If applicable, complete Lines 10a and 11a to report net income that couldn’t be included in the combined unitary income, ensuring you follow previous modifications for Wisconsin law.

- Complete Form 4M if you are a member of a combined group and ensure Line 14 reflects accurate totals.

- In Part III, enter the total nonapportionable income allocated to Wisconsin for all Form 4N filers.

- Finally, review all entries for accuracy and completeness before saving your changes.

Complete your documents online to ensure compliance and streamline your filing process.

Local IRS Taxpayer Assistance Center (TAC) – The most common tax forms and instructions are available at local TACs in IRS offices throughout the country. To find the nearest IRS TAC, use the TAC Office Locator on IRS.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.