Loading

Get 2006 Irs 8891 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 IRS 8891 Form online

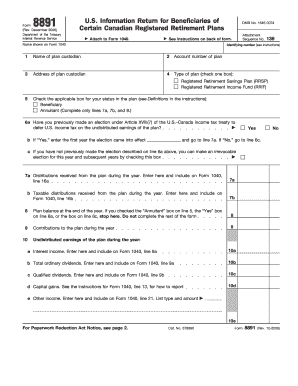

The 2006 IRS 8891 Form is essential for U.S. citizens or residents reporting contributions and distributions from certain Canadian registered retirement plans. This guide provides a step-by-step approach to successfully complete the form online.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to access the IRS 8891 Form and open it in your online editor.

- Enter your name as shown on Form 1040 in the appropriate field, ensuring accurate spelling.

- Input your identifying number, which is your U.S. social security number (SSN) or individual taxpayer identification number (ITIN). Avoid using a Canadian identifying number.

- Complete the name of the plan custodian and account number fields accurately.

- Fill in the address of the plan custodian, providing complete information.

- Select the type of plan by checking the appropriate box for Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF).

- Indicate your status in the plan by checking either 'Beneficiary' or 'Annuitant.' If you select 'Annuitant,' complete only lines 7a, 7b, and 8.

- Answer question 6a regarding previous elections under Article XVIII(7) of the U.S.–Canada income tax treaty. If applicable, provide the year the election came into effect.

- Record the distributions received from the plan during the year in line 7a and the taxable distributions in line 7b.

- If you checked the applicable boxes to stop here, complete the rest of the form only if necessary.

- Enter contributions made to the plan during the year and report undistributed earnings, such as interest income and capital gains, in the specified fields.

- Once all entries are complete, review the form to ensure accuracy, and then save your changes, download, print, or share the form as needed.

Complete your IRS 8891 Form online for accurate reporting and compliance.

When the estate is beneficiary, the income is taxable, and the account proceeds paid into the estate can be used to pay the resulting tax. The fair market value of the RRIF account on the date of death of the deceased is the income that is taxable and included on their final tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.