Loading

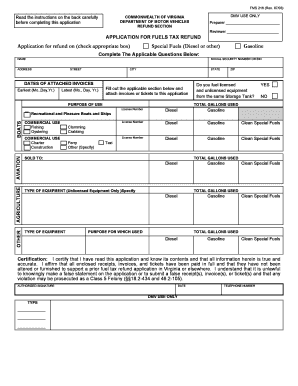

Get Application For Refund On (check Appropriate Box) Special Fuels ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Refund On Special Fuels online

Filling out the Application For Refund On Special Fuels is a straightforward process designed to help users efficiently request a refund for taxes paid on fuel. This guide will walk you through each section of the form to ensure you complete your application accurately and successfully online.

Follow the steps to fill out the application correctly.

- Press the ‘Get Form’ button to access the Application For Refund On Special Fuels and open it in your online editor.

- Complete the applicant information section by providing your name, social security number or employer identification number (EIN), address, and telephone number. Make sure all information is accurate and legible.

- Indicate the type of fuel refund you are requesting by checking the appropriate box: Special Fuels (Diesel or other) or Gasoline.

- Fill in the dates of the attached invoices, specifying the earliest and latest purchase dates in the required format (Mo., Day, Yr.).

- Provide details on the total gallons used for each type of fuel. Ensure to separate the totals for diesel and gasoline as well as for clean special fuels.

- Specify the purpose of use for the fuel and complete the applicable section based on your usage, such as agriculture or commercial use. Be specific about the type of equipment if required.

- Certify your application by adding your authorized signature and the date. Confirm that all information provided is true and that no previously submitted invoices are included.

- Attach copies of the invoices or tickets that support your application. Ensure these documents adhere to the requirements outlined in the instructions, particularly not including any showing less than five gallons.

- Once completed, you can save your changes, download the filled application, print it for your records, or share it via email.

Complete your Application For Refund On Special Fuels online today to streamline your refund process.

Who must file Form 8849? Any taxpayer who owe a refund for the federal excise taxes paid can claim a refund by reporting IRS Form 8849 by attaching a right Schedule. Form 8849 can be submitted electronically and get IRS approved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.