Loading

Get Ct It Credit 2014 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct It Credit 2014 Form online

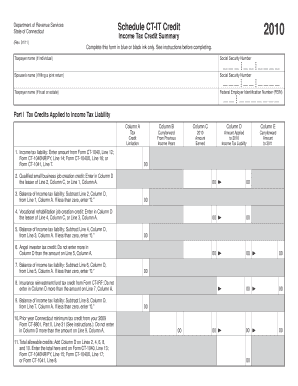

Filling out the Ct It Credit 2014 Form online is a straightforward process that can help you claim various tax credits applicable to your income tax liability. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Ct It Credit 2014 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the 'Taxpayer name' field, ensuring that you include your Social Security Number in the corresponding box. If you are filing a joint return, include your spouse's name and Social Security Number as well.

- Proceed to Part I, where you will enter your tax credits applied to your income tax liability. Begin with Line 1 by entering the income tax liability from the appropriate line on Form CT-1040, CT-1040NR/PY, CT-1040X, or CT-1041.

- Continue filling in the subsequent lines, inserting the amounts earned and applied to your income tax liability as instructed. Remember to compare and enter the lesser of the amounts where required, such as in Columns D and E.

- For Part II, if applicable, input the type of tax credit reported by a pass-through entity or by a trust or estate. Complete Columns A, B, C, and D with the appropriate information.

- Ensure that you review all entries for accuracy, including cross-referencing any attachments such as Form CT-IRF or CT-8801 if necessary.

- After completing the form, save your changes, and you may choose to download, print, or share the completed form as needed.

Complete your Ct It Credit 2014 Form online today for a smoother filing experience.

HOW TO OBTAIN CONNECTICUT TAX FORMS Connecticut state tax forms can be downloaded at the Department of Revenue Services (DRS) website: .ct.gov/drs/ Connecticut tax forms and publications are available at any DRS offices, during tax filing season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.