Loading

Get Form W 9 1999

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W 9 1999 online

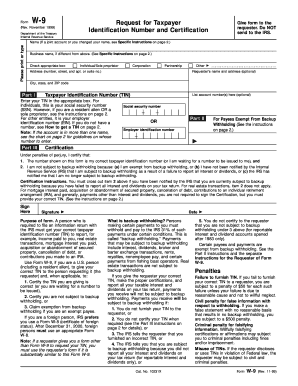

Filling out the Form W 9 is an essential task for individuals and entities need to provide their taxpayer identification number. This guide will help you understand each section and field of the form while guiding you through the process of completing it online.

Follow the steps to fill out the Form W 9 online

- Press the ‘Get Form’ button to access the form and load it in the editor.

- Start by entering your name in the designated field. If it's a joint account or if your name has changed, refer to the specific instructions for guidance.

- If applicable, enter your business name, ensuring it is distinct from your personal name.

- Select the appropriate type of entity by checking the corresponding box: Individual/Sole proprietor, Corporation, Partnership, or Other.

- Enter your address, including the number, street, and apartment or suite number.

- Provide the requester’s name and address if available, though this is optional.

- Indicate the city, state, and ZIP code for your address.

- In Part I, enter your Taxpayer Identification Number (TIN). For individuals, this will usually be your Social Security Number (SSN). If you have an Employer Identification Number (EIN) or are a resident alien, follow the specific instructions provided.

- If you believe you are exempt from backup withholding, fill out Part II accordingly and provide your TIN along with a note stating 'Exempt.'

- In Part III, review and complete the certification statement. Under penalties of perjury, certify that the TIN you provided is correct and that you are not subject to backup withholding unless otherwise noted.

- Finally, ensure to sign and date the form before submission. This step is crucial for validating your entries.

- Once completed, you can save your changes, download a copy, print it, or share the form as needed.

Complete and file your Form W 9 online to ensure prompt processing.

The W-9 is an official form furnished by the IRS for employers or other entities to verify the name, address, and tax identification number of an individual receiving income. The information taken from a W-9 form is often used to generate a 1099 tax form, which is required for income tax filing purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.