Loading

Get 2001 Form W-4 - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form W-4 - IRS online

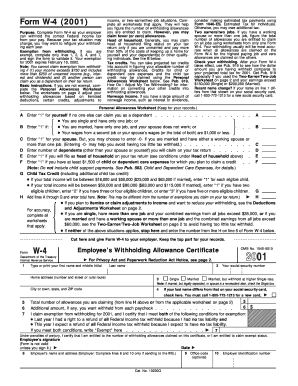

Completing the 2001 Form W-4 is essential for informing your employer about the amount of federal income tax to withhold from your pay. This guide provides a clear, step-by-step process on how to fill out this form online, ensuring that you understand each component fully.

Follow the steps to accurately complete your W-4 form.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editing tool.

- Begin by providing your first name, middle initial, and last name as required in the top section of the form.

- Enter your home address, including the street number, city, state, and ZIP code.

- Input your Social Security number in the designated field to ensure proper identification.

- Select your filing status by checking the appropriate box: Single, Married, or Married but withhold at higher Single rate.

- If your last name is different from the name on your Social Security card, check the box provided and call for a new card.

- Calculate the total number of allowances you are claiming based on the Personal Allowances Worksheet provided and enter that number on line 5.

- If you wish to withhold an additional amount from each paycheck, specify that amount on line 6.

- If you are claiming exemption from withholding, ensure you meet the specified criteria, write 'Exempt' in the provided field, and complete lines 1, 2, 3, 4, and 7.

- Sign and date the form to validate it. Remember that the form is not valid unless it is signed.

- After you have completed all the necessary fields, save your changes. You can then download, print, or share the form as needed.

Complete the 2001 Form W-4 online now to ensure accurate tax withholding!

For the latest information about developments related to Form W-4, such as legislation enacted after it was published, go to .irs.gov/FormW4. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.