Loading

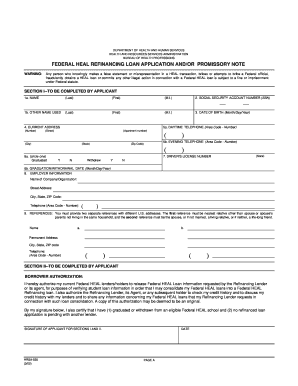

Get Federal Heal Refinancing Loan Application And/or Promissory Note

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Federal Heal Refinancing Loan Application And/or Promissory Note online

Filling out the Federal Heal Refinancing Loan Application and/or Promissory Note online can seem challenging, but following the right steps can make it straightforward. This guide provides a clear, step-by-step approach to help you complete the application with ease.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to access the form online and open it in the document editor.

- Begin by filling in Section I as the applicant. Enter your name, Social Security account number, and date of birth accurately. Ensure that any previous names used are also included if applicable.

- Provide your current address, including the street number, city, state, and zip code. Make sure all this information is current.

- Enter your daytime and evening telephone numbers to ensure that lenders can contact you. Include the area codes for each number.

- Indicate your educational status by circling if you graduated, withdrew, or are currently enrolled. Record your graduation or withdrawal date if relevant.

- Enter your employer information, including the company name, street address, city, state, zip code, and telephone number.

- Provide two references with different U.S. addresses. The first must be a nearest relative not in the same household, and the second could be a spouse or a close friend.

- Next, complete Section II, granting authorization for your current Federal HEAL lenders to release loan information to the refinancing lender. Review the authorization statement and sign with the date to validate your consent.

- If you must reference any HEAL loans under Promissory Note, complete the related sections with details such as loan holder information, original principal amounts, and current balances.

- Ensure that all sections are filled out accurately, and review the document for any errors or missing information.

- Once completed, save your changes in the document editor. You may choose to download, print, or share the finalized form as needed.

Get started on competing your Federal Heal Refinancing Loan Application online today!

A promissory note is a written agreement between one party (you, the borrower) to pay back the loan issued by another party (often a bank or other financial institution). Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.