Loading

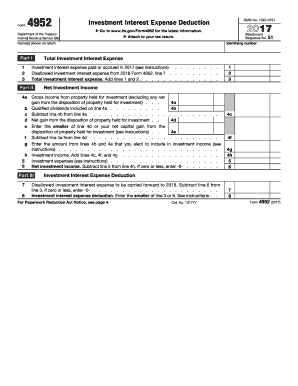

Get Instructions For 2014 Form 4952

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For 2014 Form 4952 online

Filling out the Instructions For 2014 Form 4952 can be a straightforward process with the right guidance. This guide provides step-by-step instructions to help users complete the form online efficiently.

Follow the steps to fill out the form accurately and effectively.

- Click the ‘Get Form’ button to access the form and load it in your preferred document editing tool.

- Begin by reading the introduction section of the form to understand its purpose and the information it requires.

- Locate fields that require personal identification details, such as name, address, and taxpayer identification number, and fill them in accurately.

- Proceed to fill out the sections related to your investment interest expenses, ensuring that you provide accurate figures and descriptions as prompted.

- Review any calculations or summaries that are automatically generated based on your input to confirm their accuracy.

- Once all fields are completed, you can save your changes, and choose to download or print the completed form for your records.

- Finally, share the form as needed, ensuring it is sent to the appropriate parties in accordance with filing requirements.

Start filling out your documents online to ensure a smooth and efficient filing process.

Related links form

If your expenses are less than your net investment income, the entire investment interest expense is deductible. If the interest expenses are more than the net investment income, you can deduct the expenses up to the net investment income amount. The rest of the expenses are carried forward to next year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.