Loading

Get Form 1065 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1065 Fillable online

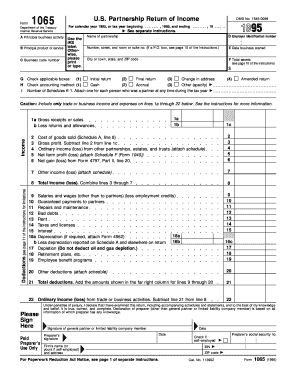

Filling out the Form 1065, U.S. Partnership Return of Income, can be a straightforward task with the right guidance. This comprehensive guide provides step-by-step instructions to help you successfully complete the form online, ensuring you capture all necessary details accurately.

Follow the steps to complete the Form 1065 Fillable online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the partnership in the designated field labeled 'Name of partnership.' This information identifies your business for tax purposes.

- Provide the Employer Identification Number (EIN) in the appropriate area. This unique number is assigned by the Internal Revenue Service (IRS) and is crucial for identification.

- Fill in the address details, including the number, street, and room or suite number, ensuring to follow the instructions provided.

- Indicate the date the business started by entering the month, day, and year in the specified fields.

- Complete the section for total assets. Enter the total value of all the assets owned by the partnership as of the end of the tax year.

- Select the applicable boxes for returns (initial, final, change of address, etc.) to confirm the nature of the return.

- Choose the accounting method used (cash, accrual, or other) to reflect how income and expenses are reported.

- Proceed to the income section. Start with gross receipts or sales, then deduct any returns and allowances to arrive at the net sales.

- Fill in the deductions section carefully. List all necessary expenses such as salaries, guaranteed payments, repairs, interest, and other relevant expenses.

- Calculate total income or loss by combining the appropriate income figures and subtracting the total deductions.

- Review your entries throughout the form to ensure accuracy and completeness.

- Once all sections are completed, you can save the form, download it for your records, print it, or share it as needed.

Start completing your Form 1065 online today for accurate and efficient filing.

After filing Form 1065, each partner is provided a Schedule K-1 by the Partnership. ... The K-1 reflects a partner's share of income, deductions, credits and other items that the partner will need to report on their individual tax return (Form 1040).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.