Loading

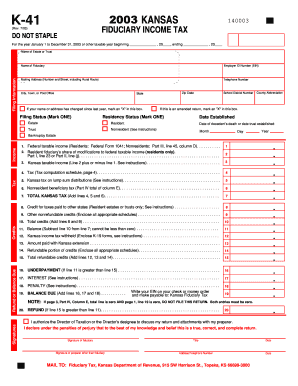

Get Kansas 2012 K 41 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kansas 2012 K 41 Form online

Filling out the Kansas 2012 K 41 Form online can streamline the process of reporting fiduciary income tax. This guide provides clear, step-by-step instructions on how to effectively complete this form, ensuring compliance and accuracy.

Follow the steps to fill out your Kansas 2012 K 41 Form online.

- Click ‘Get Form’ button to access the Kansas 2012 K 41 Form and open it in your preferred editor.

- Fill in the filing information section. Start by entering the name of the estate or trust and the name of the fiduciary. Include the Employer Identification Number (EIN), mailing address, and telephone number. Make sure that all details are accurate.

- Indicate your filing status by marking the appropriate box: Resident, Trust, or Nonresident. If applicable, provide the county abbreviation and check the box if this is an amended return.

- Complete the residency status section by marking whether it is an Estate or identify the School District Number. Ensure to fill out the zip code and state where necessary.

- Enter the dates for the taxable year, including the date established and the date of the decedent’s death or the date the trust was established.

- Report the federal taxable income on line 1, ensuring to reference Federal Form 1041 for residents or Part III, line 45 for nonresidents.

- For residents only, provide modifications to federal taxable income as necessary. Calculate and enter your Kansas taxable income on the designated line.

- Complete the tax computation, following the tax computation schedule provided on page 4 of the form. Aggregate the total Kansas tax as outlined.

- If applicable, report any credits for taxes paid to other states, as well as other nonrefundable credits. Total these credits, and ensure the resulting amounts are correct.

- Calculate the balance due or the refund amount, and fill out the corresponding lines based on your calculations.

- Sign the form, providing your signature and the date. If a preparer is involved, they must also sign, providing their contact information.

- Once all fields are completed, review the form for accuracy. Save your changes, and then you can download, print, or share the completed form for your records or submission.

Start filling out your Kansas 2012 K 41 Form online today to ensure your fiduciary income tax is accurately reported.

Do I need to file an extension with Kansas? Kansas accepts the federal extension of time and will follow ingly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.