Loading

Get Homestead Property Tax Refunds 'here For Us To Take ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Homestead Property Tax Refunds 'here For Us To Take ... online

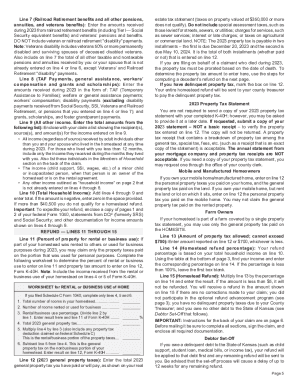

This guide provides comprehensive, step-by-step instructions for completing the Homestead Property Tax Refunds form, commonly referred to as 'here For Us To Take ...', online. By following these instructions, users can ensure their claims are processed efficiently.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to download the form and open it in your preferred editor.

- Begin by providing your personal information. Enter your Social Security number, name, and address in the designated fields. Make sure to use uppercase letters for your last name.

- Indicate if the claimant is deceased by marking the appropriate box and entering the date of death, if applicable.

- Complete the qualifications section. Answer only the questions that apply to you, including age, disability status, or if you have a dependent child.

- In the household income section, input the total income amounts received in 2023 across various categories, such as wages, pensions, and any other applicable income.

- Calculate your total household income by adding the figures from the previous section. Ensure that you do not exceed the established income limits for qualification.

- Provide details regarding property taxes paid in 2023, ensuring to exclude special assessments. If there are any delinquent taxes, mark the respective box.

- Calculate your property tax refund by using the figures collected in the previous steps and refer to the provided refund percentage table to determine your refund amount.

- Sign the form, acknowledging that all information is accurate to the best of your knowledge. If applicable, a preparer's signature is also required.

- Once completed, save changes to the form, and you may choose to download or print a copy for your records before submitting it.

Complete your Homestead Property Tax Refunds form online today to ensure a swift processing of your claim.

The standard refund time frame for a direct deposit from the IRS is 8-14 days. Generally speaking, the IRS deposits money on a Friday. However, your bank may take a day or two extra to post it to your account. If you chose to have a check mailed to you, it will take approximately 10 days longer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.