Loading

Get 2022 Form 502w - Pass-through Entity Withholding Tax Payment. Form 502w - 2022 Pass-through Entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

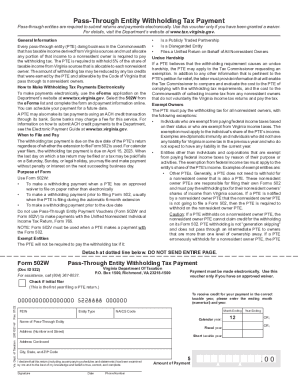

How to fill out the 2022 Form 502W - Pass-Through Entity Withholding Tax Payment

This guide aims to assist users in completing the 2022 Form 502W, which pertains to the withholding tax payment for pass-through entities. The instructions provided here ensure that individuals and organizations understand each part of the form, making the filing process straightforward and efficient.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred format.

- Fill in the PTE’s Federal Employer Identification Number (FEIN), which is essential for identification.

- Indicate the entity type by entering the appropriate code corresponding to your organization, such as SC for S Corporations, PG for General Partnerships, or OB for Others.

- Provide the 6-digit North American Industry Classification System (NAICS) code relevant to your pass-through entity.

- Enter the relevant ending month and year for the payment to ensure accurate credit for the taxable year.

- Include the name of the pass-through entity in the designated field, followed by the complete address, including street number, city, state, and ZIP code.

- Calculate the total amount withheld for all nonresident owners by determining the taxable income and applying the 5% rate, adjusting for credits where applicable.

- In the payment amount block, state the total payment due.

- Be sure to sign the form, date it, and provide a contact phone number for any inquiries.

- Upon completion, save the changes, and you can download, print, or share the form as needed.

Complete your documents online with confidence and ensure your compliance with all requirements.

One of the main tax benefits of electing a pass-through business structure is avoiding double taxation. Business earnings are only taxed once, on the owner or shareholder's personal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.