Loading

Get 1702-rt June B2013b Editable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1702-RT June B2013b Editable online

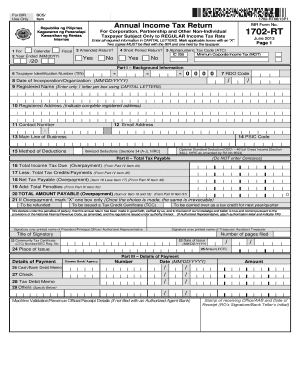

This guide provides comprehensive instructions on how to fill out the 1702-RT June B2013b Editable form online. Designed for corporations, partnerships, and other non-individual taxpayers, this form is essential for filing annual income tax returns.

Follow the steps to successfully complete the 1702-RT form online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin filling out Part I – Background Information. Enter your Taxpayer Identification Number (TIN) in the designated field and make sure to use capital letters for all entries. Include your Registered Name, complete Registered Address, Contact Number, and Email Address.

- Indicate your Reporting Period and choose whether the return is amended or a short period return. Mark applicable boxes with an ‘X’ for clarity.

- Complete Part II – Total Tax Payable section, inputting figures for Total Income Tax Due, Tax Credits, and Net Tax Payable. Ensure calculations are accurate and consistent across all applicable items.

- In Part IV – Computation of Tax, provide details for Net Sales/Revenues, Cost of Sales/Services, and allowable deductions. Make sure to detail income and expenses precisely to avoid errors in calculations.

- Proceed to Schedules as necessary, attaching additional sheets if required. Ensure that all schedules correspond accurately to figures entered in main sections.

- Fill out the final sections, including Part V – Tax Relief Availment, if applicable, and provide information regarding your External Auditor/Accredited Tax Agent in Part VI.

- After completing all sections, review the form for accuracy. Save your changes, and opt to download, print, or share the form as needed.

Complete your 1702-RT form online today for a seamless filing experience.

1702-MX. Annual Income Tax Return For Corporation, Partnership and Other Non-Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.