Loading

Get Affidavit Of Exemption From Documentary Transfer Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Affidavit Of Exemption From Documentary Transfer Tax online

Filling out the Affidavit Of Exemption From Documentary Transfer Tax online can be a straightforward process, provided you have the necessary information at hand. This guide will help you navigate each section of the form to ensure accuracy and compliance during your online filing.

Follow the steps to complete the affidavit online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

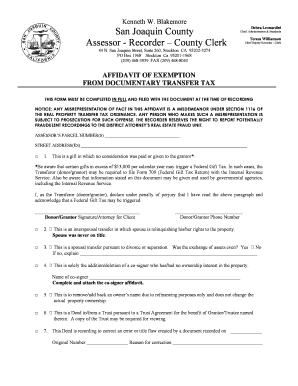

- Locate the Assessors Parcel Number field and enter the appropriate number that identifies the property involved in the transaction.

- Fill in the street address of the property in the designated area, ensuring that all details are accurate and complete.

- Determine the reason for the exemption as outlined in the form and check the corresponding box. Provide any additional explanations required, particularly if indicating a spousal transfer or a correction of an error.

- If applicable, complete the section regarding the addition or deletion of a co-signer by including their name and any necessary attachments.

- For cases involving a trust, check the appropriate box and be prepared to attach a copy of the trust document if required.

- Review all filled sections for accuracy, and ensure that all signatures are present, including those of the grantor or their attorney.

- Complete the final sections by entering the date of execution, place of execution, and contact information for either the transferor or transferee.

- Once the form is fully completed, save the changes, download a copy for your records, and print the document if necessary for submission.

Compete your documents online to ensure a smooth filing process.

There are certain exemptions to the payment of the Documentary Transfer Tax. Such exemptions include, transfers that are a “gift” and can be proven that no money was involved; transfers between individuals and their Revocable Trusts; transfers between spouses for no value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.