Loading

Get Ct W3 Hhe 2015 Connecticut Annual Reconciliation Of Withholding For Household Employers 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT W3 HHE 2015 Connecticut Annual Reconciliation Of Withholding For Household Employers 2015 online

Filing the CT W3 HHE 2015 form is essential for household employers in Connecticut to reconcile withholding for employees. This guide provides clear, step-by-step instructions for completing the form online, ensuring the process is straightforward and manageable.

Follow the steps to fill out the CT W3 HHE 2015 form accurately online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

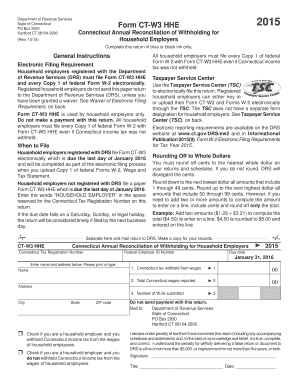

- Enter your Connecticut Tax Registration Number and Federal Employer ID Number in the designated fields. If you are not registered, write 'HOUSEHOLD EMPLOYER' where required.

- Provide your name, address, city, state, and ZIP code in the spaces provided. Ensure that the information is accurate and clearly formatted.

- Indicate whether you are a household employer who withholds Connecticut income tax or not by checking the appropriate boxes.

- Enter the total Connecticut income tax withheld from wages during the calendar year on Line 1. This should match the total reported on the back of the form.

- On Line 2, report the total Connecticut wages paid during the calendar year. This includes wages for residents paid for work inside or outside Connecticut.

- Fill in Line 3 with the number of W-2 forms you are submitting along with this return.

- Complete the declaration section by signing the form, indicating your title, and writing the date.

- Review the form for accuracy and compliance with rounding off to whole dollars as outlined in the general instructions.

- Once all sections are completed, save your changes, and then proceed to download or print the completed form for your records before submitting it electronically.

Start filling out the CT W3 HHE 2015 form online today to ensure timely submission and compliance.

Form CT-941 is used to reconcile quarterly Connecticut income tax withholding from wages only. Form CT-941 must be filed and paid electronically unless certain conditions are met. File this return and make payment electronically using myconneCT at portal.ct.gov/DRS-myconneCT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.