Loading

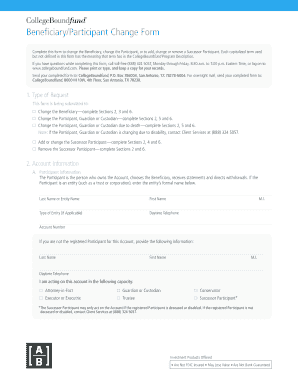

Get Collegeboundfund Beneficiary/participant Change Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CollegeBoundfund Beneficiary/Participant Change Form online

Completing the CollegeBoundfund Beneficiary/Participant Change Form online is a straightforward process that ensures you can manage your account efficiently. This guide will walk you through each section of the form with clear instructions, making it easy to update your beneficiary or participant information.

Follow the steps to fill out the CollegeBoundfund form online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Identify the type of request you are submitting. You will need to specify whether you are changing the beneficiary, participant, or making adjustments to the successor participant based on the options provided.

- In the Account Information section, fill in the participant's details such as last name, first name, middle initial, and contact information. Ensure that you also provide the account number and indicate your relationship to the account.

- For the Beneficiary Information section, enter the beneficiary's details including their last name, first name, and middle initial. Make sure to specify the new beneficiary if applicable, and provide any necessary documentation.

- If you are adding or changing a Successor Participant, complete the relevant fields with their information, including social security number, date of birth, and mailing address.

- Complete the New Participant, Guardian, or Custodian section if applicable, providing information as required. If the new participant is a minor, ensure the guardian signs in the designated area.

- Select your e-Delivery options if you prefer to receive updates and statements electronically, providing your email address and selecting your preferences.

- Sign and date the form in the Signature section, ensuring all required fields are completed and the Medallion Signature Guarantee Stamp is provided if necessary.

- Once all sections are complete, save your changes. You can then choose to download, print, or share the completed form as needed.

Complete the CollegeBoundfund Beneficiary/Participant Change Form online to manage your account effectively.

Related links form

If you are able to transfer ownership, you can typically do it penalty-free only once during a 12-month period. If you transfer again, it would be considered a nonqualified distribution and would incur a penalty and have federal income tax implications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.