Loading

Get Ny It-230 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-230 online

This guide provides a clear and detailed approach to completing the NY IT-230 form online, ensuring that users understand each section and field with ease. By following these steps, you will be well-equipped to submit your tax information accurately and efficiently.

Follow the steps to successfully complete the NY IT-230 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your name as it appears on your tax return in the designated field.

- Provide your identification number, ensuring it is entered correctly to avoid any discrepancies.

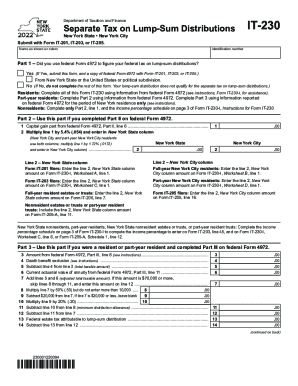

- Part 1 requires you to indicate whether you used federal Form 4972 to calculate your federal tax on lump-sum distributions. If you answered 'Yes', make sure to submit this form along with a copy of federal Form 4972 when filing Form IT-201, IT-203, or IT-205. If 'No', you do not need to complete the rest of the form.

- For residents, proceed to fill out all sections using the information from federal Form 4972, as outlined in the instructions. If you are a part-year resident, complete Part 2 with data from Form 4972 and Part 3 with the relevant information reported for the period you were a New York resident.

- If you are a nonresident, only complete Part 2, line 1, and the income percentage schedule as detailed in the instructions.

- Continue to Part 2, where you will input the capital gain figures from federal Form 4972. Perform the calculations as specified, entering the results in the corresponding columns for New York State and New York City, if applicable.

- If you're required to complete Part 3, follow the instructions to report amounts from federal Form 4972. Ensure precision in your calculations to determine the taxable amounts and minimum distribution allowance.

- After completing the necessary parts, review your entries for accuracy. Make sure all figures are correct and calculations are precise.

- Finally, save your changes, and choose whether to download, print, or share the completed form according to your needs.

Complete your NY IT-230 online today for a smoother tax filing experience!

New York state has nine income tax rates: 4%, 4.5%, 5.25%, 5.85%, 6.25%, 6.85%, 9.65%, 10.3% and 10.9%. New York state income tax brackets and income tax rates depend on your taxable income and filing status. Residency status also determines what's taxable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.