Loading

Get Request For Six-month Extension Of Time To File Form Ct-990t Only - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

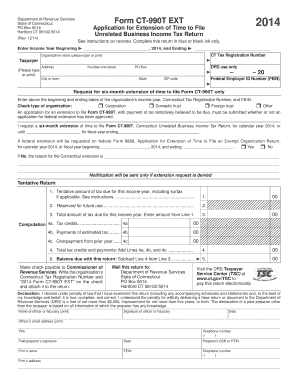

How to fill out the Request For Six-month Extension Of Time To File Form CT-990T Only - Ct online

Filing for a six-month extension to submit your Form CT-990T can significantly ease your tax-related processes. This guide offers clear and detailed instructions for completing the Request For Six-month Extension Of Time To File Form CT-990T online, ensuring that even users with little legal experience can navigate the process smoothly.

Follow the steps to effectively complete your extension request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the beginning and ending dates for the organization’s income year in the designated fields. Ensure that these dates accurately reflect the income period you are reporting.

- Provide the Connecticut Tax Registration Number and the Federal Employer Identification Number (FEIN) in the specified areas.

- Select the type of organization by checking the appropriate box, such as Corporation, Domestic trust, Foreign trust, or Other.

- Indicate whether you are requesting a six-month extension of time to file Form CT-990T. Enter the requested dates for the extension, based on the calendar or fiscal year.

- Complete the Tentative Return section by entering the tentative amount of tax due and other related calculations. Make sure to include any applicable surtax.

- Fill out the declaration section, ensuring that it is signed by an authorized officer or fiduciary of the organization. Provide the officer's email, title, and telephone number.

- If applicable, the paid preparer must also sign the form and include their Social Security Number (SSN) or Preparer Tax Identification Number (PTIN) and firm details.

- Once the form is completed, users can save changes, download, print, or share the form as needed.

Complete your documents online to ensure timely filing.

When you file your state return, you only need to attach a copy of your federal extension form. If you owe state tax, you typically must file state tax extension to avoid penalties. Contact your state tax office to verify the state extension requirements and to get the extension form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.